Coface publishes its 2025 survey on corporate payment behavior in Latin America, conducted among more than 300 companies across Argentina, Brazil, Chile, Colombia, Ecuador and Peru. In a fragile economic environment, companies have extended their payment delays to support business activity, while the frequency of late payments has increased significantly.

Key Highlights

• Payment terms: the average payment period increased from 53 to 59 days in 2025

• Late payments: 77% of companies report late payments (51% in 2024)

• Length of delays: average down to 42 days (52 days in 2024)

• Significant contrasts between countries: Brazil has the longest payment terms (66 days); while Ecuador experiences the longest payment delays (70 days).

• Nearly 70% of companies anticipate an improvement in their business in 2026, despite persistent risks (slowing growth, high interest rates, competition).

South American companies are adapting to a challenging environment: they are extending payment terms to support sales, while managing more frequent delays. While visibility for 2026 is cautiously optimistic, financing constraints, exchange rate volatility and trade uncertainties are main concerns

explains Patricia Krause, Latin America economist at Coface.

Longer lead times to support business activity

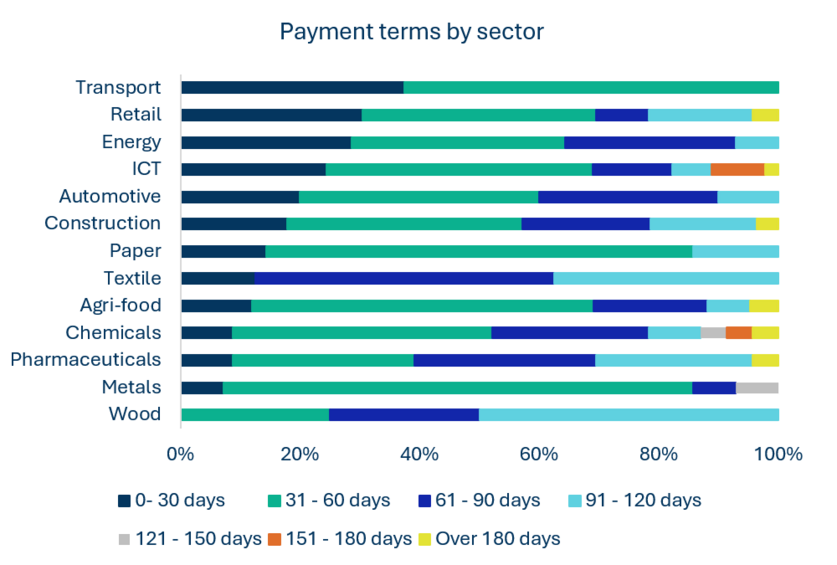

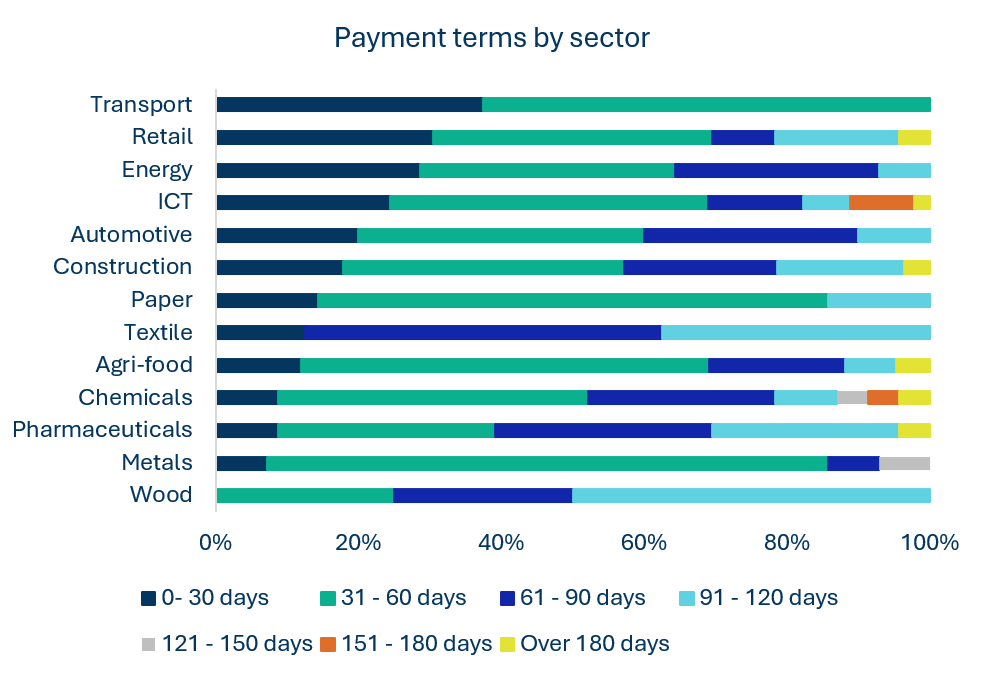

In 2025, 86% of respondents grant credit sales (a slight decrease from 88% in 2024). Payment terms of 31–60 days remain the most common, but the share of 91- 120 days is increasing, bringing the average to 59 days. By country, Brazil has the longest average payment terms (66 days), while Colombia has the shortest (50 days).

In terms of sectors, wood, textiles and pharmaceuticals offer the most generous average payment terms, while the transport sector remains more restrictive.

Data for the graphs in .xls format

More frequent delays, linked to multifaceted cash flow pressure

Late payments are becoming more widespread (77% of respondents report having experienced late payments), but their average duration has fallen to 42 days, indicating faster resolution in several sectors (particularly pharmaceuticals and chemicals observed the sharpest drop compared to 2024).

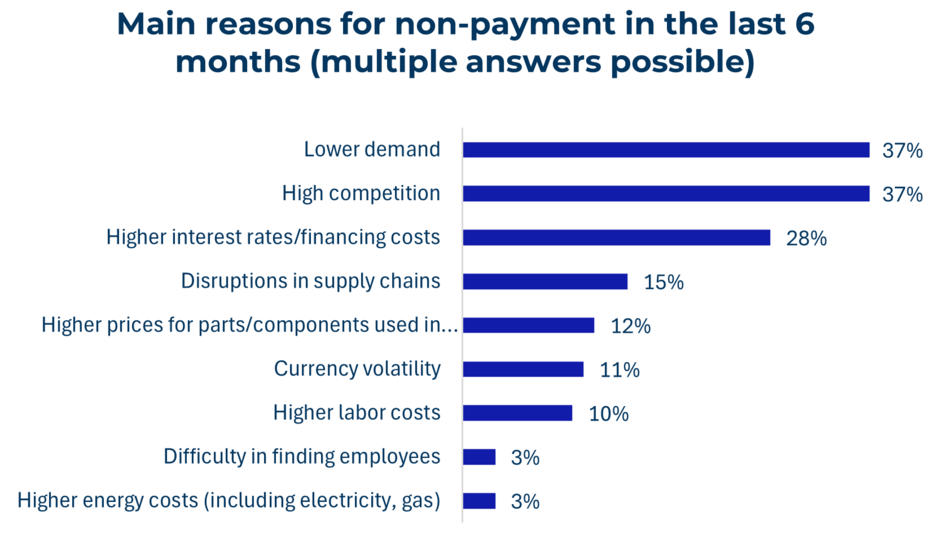

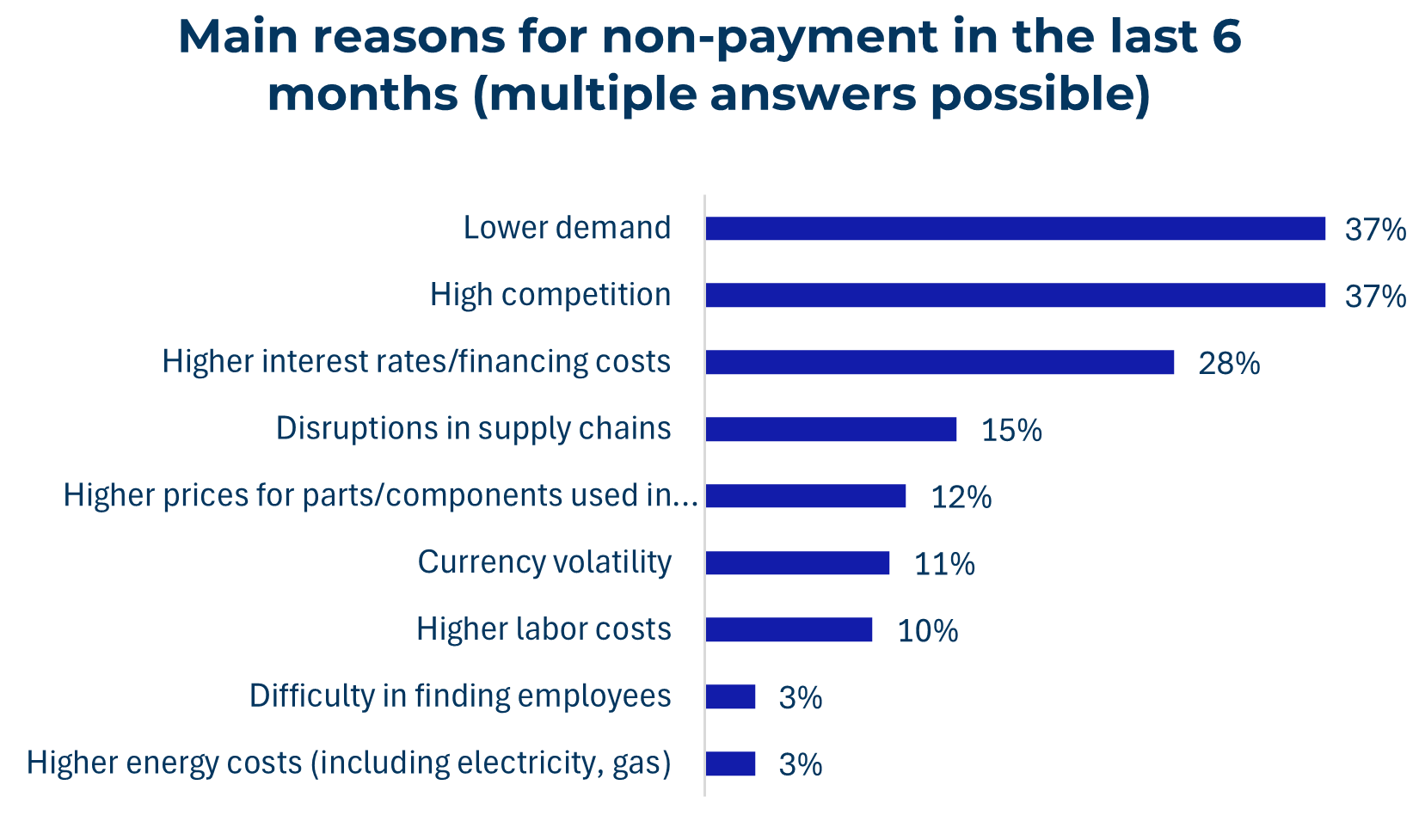

Argentina and Chile have the shortest average durations (26-27 days), compared to an average of 70 days for Ecuador. The most frequently cited causes are weak demand and competitive pressure (37% each), followed by high financing costs (28%). Tight credit conditions particularly in Brazil and Colombia continue to limit companies' ability to finance their current needs, thereby increasing their exposure to payment delays. Exchange rate volatility, changes in trade policy and rising labour costs are also adding to traditional constraints (competition, geopolitical tensions).

2026: businesses more confident, but still vulnerable

Despite modest regional growth expectations, nearly 70% of respondents anticipate an improvement in their business in 2026. Optimism about business performance prevailed across all countries.

By sector, metals stood out as the only one in which most respondents expect stability. Key risks continue to be cited by companies: economic slowdown (46%), competition (44%), geopolitical tensions (36%), high interest rates (34%) and exchange rate volatility, with Argentina being particularly affected.

Data for the graphs in .xls format

Download the full study (0.7Mb in .pdf format) to better understand what is at stake in Latin America in the next months.

Want to protect your business from longer payment delays? Contact our experts near you