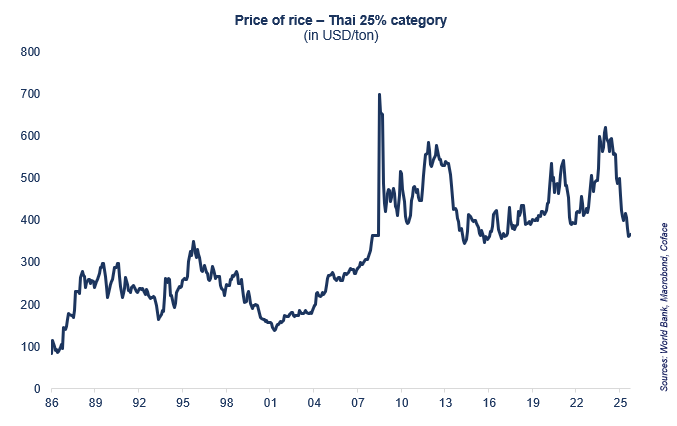

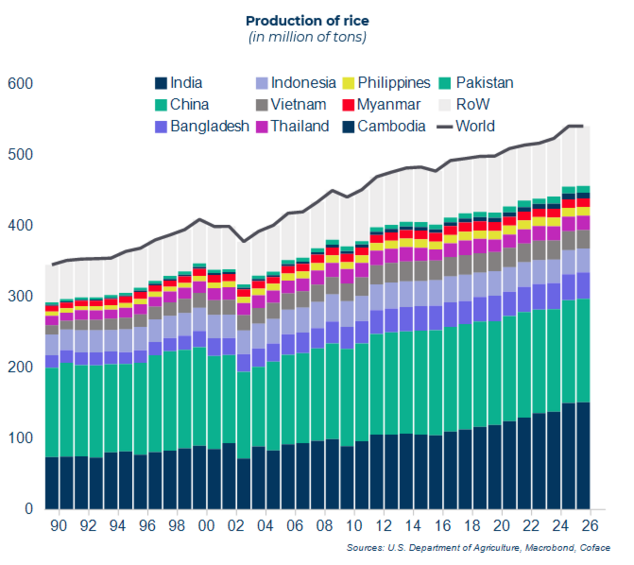

Rice prices have fallen 35% in one year to their lowest level since 2017 (around US$360 per ton) following the lifting of Indian export restrictions. After three years of extreme volatility, the market is facing a glut (541 million tons produced in 2024), pushing prices down and upsetting the balance for global producers and importers.

Three years of record volatility

Since 2022, India, the world's leading exporter, had restricted its export sales to contain the surge in world prices (19% increase in 2022 and 2023) linked in particular to the war in Ukraine and poor weather conditions in Asia. The reopening of exports in 2024, coupled with record Asian harvests, led to a 35% drop in prices in one year. Given the upward production forecasts for 2026 and the potential return of La Niña in the fourth quarter of 2025, we anticipate a growing supply surplus in 2026. Prices are expected to continue falling at least until the end of 2025, with likely stabilization in 2026 at levels not seen in 10 years.

data for the graph in .xls file

Asia dominates the market; Africa is highly dependent

Rice is the most widely consumed staple food in the world, ahead of wheat and maize.

Despite its importance for food security, it is still little traded on world markets, with Asia, which accounts for nearly 90% of global production and consumption, remaining the main player.

Sub-Saharan Africa, for its part, is heavily dependent on Asian imports. In 2024, five Asian countries1 accounted for 75% of exports, including 40% for India, a concentration that increases the vulnerability of these countries to the political decisions of Asian economies.

A major political issue throughout Asia

Rice remains a highly politicized commodity in many Asian economies.

The continuing fall in prices threatens the profitability of producers in countries where production is lower than in India. The Philippines, one of the world's largest rice importers, has suspended imports for 60 days since September 1st to support its producers. Indonesia, for its part, has shifted towards a food sovereignty strategy, prioritizing domestic production to reduce its dependence on imports.

data for the graph in .xls file

Emerging economies are maintaining protectionist policies. This is the case in Japan, which, under pressure from agricultural lobbies, maintains strict import quotas to protect its rice sector. However, this approach risks destabilizing the dynamics of the domestic market. Indeed, the Japanese rice sector is facing a supply crisis due to the poor harvest of 2023, caused by extreme heat that reduced yields. Storage and a major earthquake in southern Japan in August 2024 have exacerbated the supply shortage. Protectionist policies keep domestic prices very high, especially when domestic production declines. A 5 kg bag of rice currently costs around 4,000 yen (US$26) in Tokyo, compared to US$8 for an equivalent bag of Thai rice in Bangkok.

1 India, Thailand, Vietnam, Pakistan, Cambodia