Wood has been added to the growing list of products subject to specific tariffs in the United States. These new measures could reshape sourcing strategies and pricing dynamics for importers and manufacturers. Find out what this could mean for your business.

Announced on 29 September, 10% tariffs on softwood — in both timber and lumber form — and 25% on certain wooden furniture, including kitchen, bathroom, and upholstered wooden furniture, have been in effect since 14 October. Tariffs on kitchen and bathroom furniture will be raised from 1 January 2026.

Wood, a strategic product under surveillance

Countries that have recently signed trade agreements with the United States – the European Union, the United Kingdom and Japan – are not subject to the same measures. For them, the rate applied is the lower of the new sectoral tariffs and the rate negotiated under the agreement. For example, the European Union, which accounts for 16% of US imports of raw wood and lumber and 8% of wooden furniture, benefit from a maximum rate of 15% on these products. As for Mexico and Canada, their free trade agreement with Washington (CAFTA) exempts some of their exports to the United States from customs duties.

Like pharmaceuticals, steel, and other products targeted by sector-specific measures, softwood lumber is receiving particular attention from the US administration due to the country's heavy dependence on imports. In 2024, the United States imported four times more softwood lumber than it exported. In addition, this type of wood is widely used in civil and military construction, making it a valuable commodity in the eyes of the U.S. government.

This attention is not new. Widely used in construction, softwood is at the center of a long-standing trade dispute between Washington and Ottawa. Since the early 1980s, the United States has denounced the logging rights granted to Canadian forestry companies, which it considers too low and likely to distort competition to the detriment of the US industry. This dispute has led to the imposition of countervailing and anti-dumping duties, which were raised from 14.4% to 35.2% for most Canadian exporters in the sector this summer.

Targeted customs duties with limited impact on trade flows

However, this set of taxes on wood, whether targeted at a trading partner or not, is unlikely to disrupt the American supply of softwood. Indeed, it is unlikely that US companies will turn away from imports in favour of local sawmills, as the price difference remains a deterrent. In 2024, US wood was about three times more expensive than imported wood, using US export prices as an indicator of domestic prices.

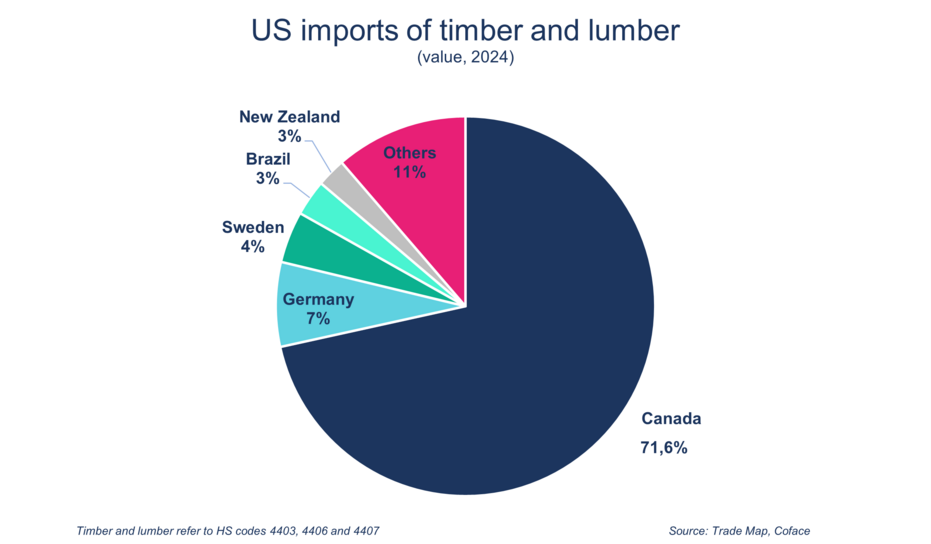

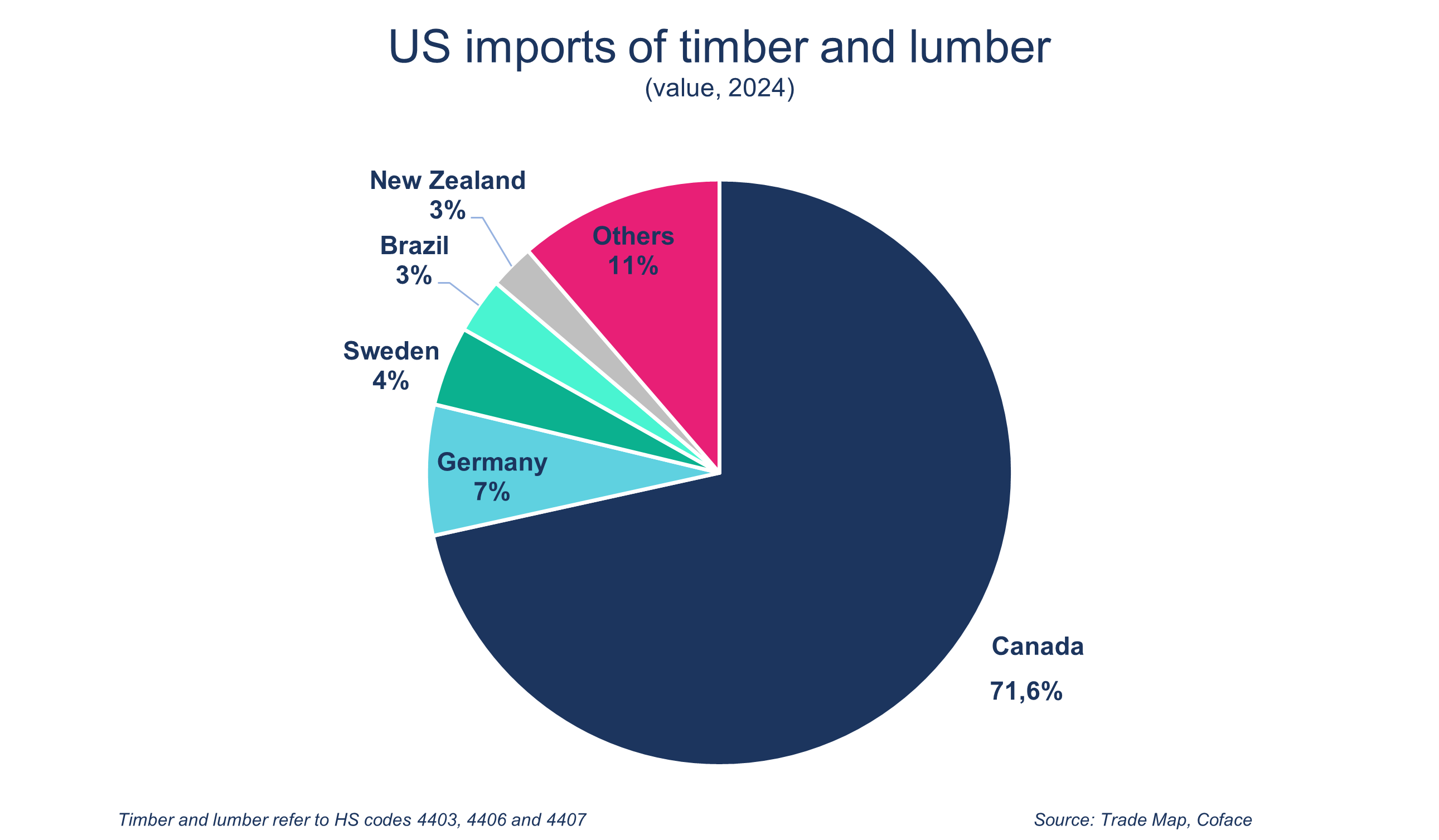

Data of the graph in .xls format

Even among import sources, few changes are expected. Supplying more than 70% of US imports of raw wood and lumber, Canada is on the front line when it comes to these softwood tariffs. This is especially true since the 10% tariffs are in addition to the countervailing and anti-dumping duties, against a backdrop of increasingly tense trade relations between Ottawa and Washington. However, the impact on Canada needs to be qualified. First, a large portion of Canadian wood exports remain exempt from the 10% tariff thanks to the CUSMA, at least until its renegotiation scheduled for 2026. Furthermore, despite the increase in other taxes applied to Canadian softwood lumber, it retains a clear advantage: in 2024, its import price on the US market was about 50% lower than that of wood from the European Union. The increase in duties will therefore not be enough to erase Canada's competitive advantage.

On the other hand, wooden furniture, mostly imported from Vietnam and Mexico, is likely to be hit harder. Their level of processing makes it difficult to comply with CUSMA criteria, exposing them to tariffs.

Expected effects on prices, but not on local production

As a result, customs duties are unlikely to be enough to stimulate sluggish production in US sawmills. The latter is struggling to regain momentum after a 6.5% decline in 2019. As a result, in 2024, the production index for sawmills and wood preservation was still below its 2018 level (-5.6%).

Tariffs, could, however, put upward pressure on wood prices in the US market. If this increase is not absorbed by exporters, it is likely to be passed on to businesses - whether upstream producers, intermediate manufacturers, wholesalers, retailers - or US consumers.

Learn more

• Everything you need to know on EUDR (the EU regulation that introduces mandatory due diligence for companies linked to key forest-risk commodities) in this Trade Talk podcast

EUDR: A game changer for businesses and global trade

Time spent 00:00

Total duration 10:54

• Coface's Risk Assessment on Wood sector