Donald Trump announced last Friday, 30th May, 25% additional tariffs on crude steel, primary aluminum and derivative products, bringing the total tariffs to 50%. This drastic measure bolsters uncertainty through the American manufacturing value chain.

Washington keeps rising tariffs on steel and aluminum, eroding manufacturing companies' margins without any certainty of revitalizing its metallurgical industry.

Simon Lacoume, sector analyst at Coface.

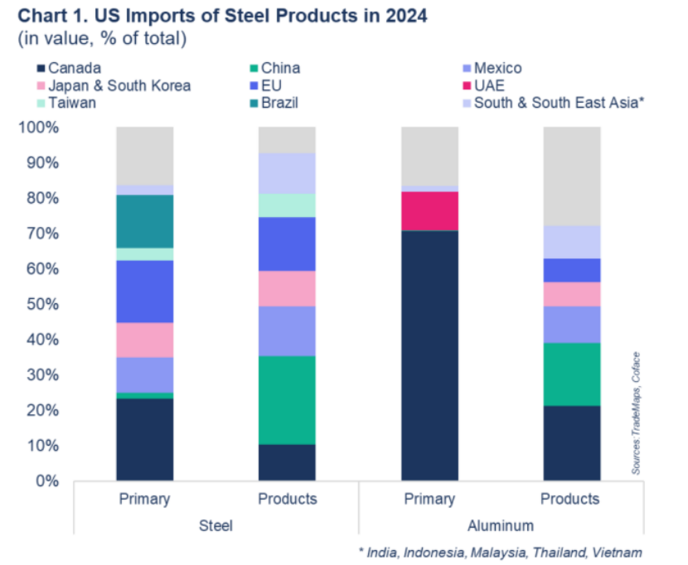

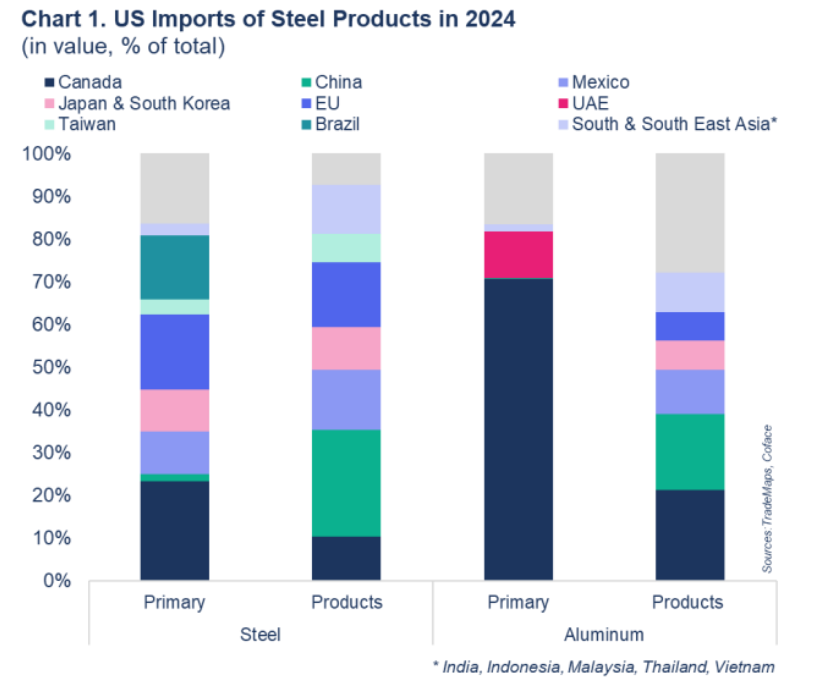

The announcement was made during the inauguration of a strategic partnership between US Steel and Japan's Nippon Steel. It involves investing USD 14 billion in the steelmaker's US plants over 14 months. This significant investment is partly a response to the initial 25% tariffs on steel introduced by Washington in March. From an American perspective, this investment serves two purposes: reducing the US’ dependence on imports and supporting its domestic metals industry. At the global level, these new tariffs will primarily impact Canada, China, Mexico, European Union (EU) and few Asian countries1.

A blow to the US manufacturing industry

Following the 2018 Trump’s tariffs, US steel production remained steady at approximately 80 million tons annually through 2024, and tariffs on steel may have led to an increase of 1,000 jobs in steel industry. However, according to a Federal Reserve Board of Governors’ study, increased input costs due to those tariffs are associated with 75,000 fewer jobs in the domestic manufacturing sector. 2018 tariffs therefore failed to deliver any long-term growth in production or employment in US industries.

(data for the graph in .xls format)

Furthermore, since the beginning of the year, tariffs have primarily pushed prices of both steel and aluminum on the US market up. The US Midwest Premium2 has risen significantly compared to pre-tariffs level: by 20% year-to-date (YTD) for steel, and by 65% YTD for aluminum. For now, American steel production keeps falling as the potential impact on production (and employment) could be only visible in the long term. Over the first four months of 2025, US production has declined by 2% year-on-year (YoY), while it dropped by 1% YoY worldwide.

Rising domestic steel prices placed a heavy burden on downstream US manufacturing firms in 2018. Price volatility and rising costs are expected to disrupt downstream segments of the value chain.

- In the short term, we expect those additional tariffs to drive US prices even higher, although volatility remains the major risk. Since Trump’s announcement las t week, the Premium US Midwest Aluminum Premium has surged by 6%, while the steel equivalent price index has dropped by more than 5%.

- In the medium term, rising domestic prices of metals could erode manufacturing companies' margins. The US automotive sector will be particularly vulnerable as both upstream and downstream value chains are likely to be negatively affected.

- In the long term, rising US tariffs on steel and aluminum could wryly benefit Mexico. As most of its automotive exports to the US meet USMCA requirements, they are exempt from tariffs. Meanwhile its production should become even more competitive due to the distortion of production costs compared to the US, further exacerbated by these additional tariffs.

1 India, Indonesia, Japan, Malaysia, South Korea, Thailand and Vietnam

2 The 'Midwest Premium' is a regional price index established by S&P Global Platts for raw materials such as steel and aluminum, supplied to the Midwest region of the United States. It is one of many regional commodity price assessments that market participants can use as a reference point to understand the current price of a given raw material in a specific region of the world.