China's dominance in the global apparel industry is crumbling, weakened by rising costs, regulatory constraints and unprofitable specialization. The return of Donald Trump to the White House and his aggressive trade policy could accelerate the diversification of supply chains. Coface identifies the countries set to play a growing role in global clothing production.

Three key trends

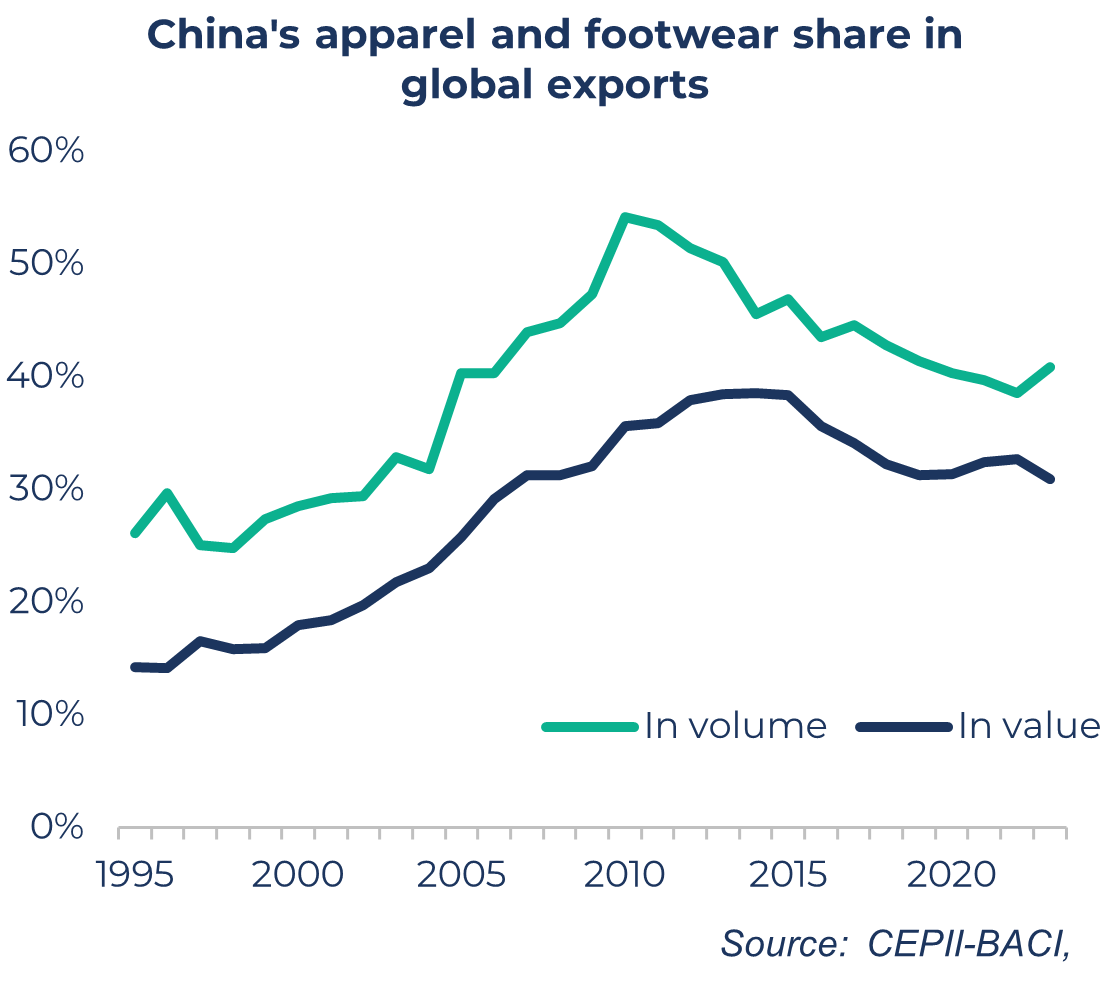

- China is losing ground: its share of global clothing exports has fallen from 54% in 2010 to 41% in 2023.

- South and Southeast Asia are gaining ground: Bangladesh, Cambodia, Pakistan, Vietnam and India are best placed if uniform customs duties are applied.

- Europe is gaining ground: with reciprocal customs duties, Albania, Georgia and other European countries would become relatively more competitive.

Trade liberalization and China's export power

The gradual removal of textile quotas between 1995 and 2005, combined with China's entry into the WTO in 2001, greatly stimulated its exports of clothing and footwear, which increased 4.8-fold between 1995 and 2010 (compared with 1.4-fold for the rest of the world).

However, this breakthrough cannot be explained solely by trade liberalization. China has taken advantage of its large population and low labor costs (a key factor representing 20 to 30% of the final cost of a garment), vast resources of natural and chemical textile fibers, and political stability.

Global competition: the limits of the Chinese model

Although China remains the world's leading exporter of clothing, its dominance is weakening. Its share of global exports has fallen from 54% in 2010 to 41% in 2023.

data for the graph in xls format

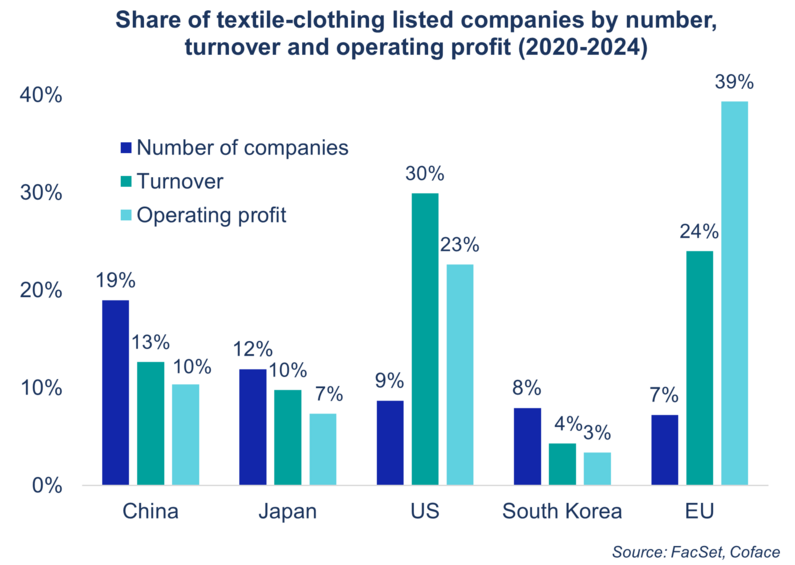

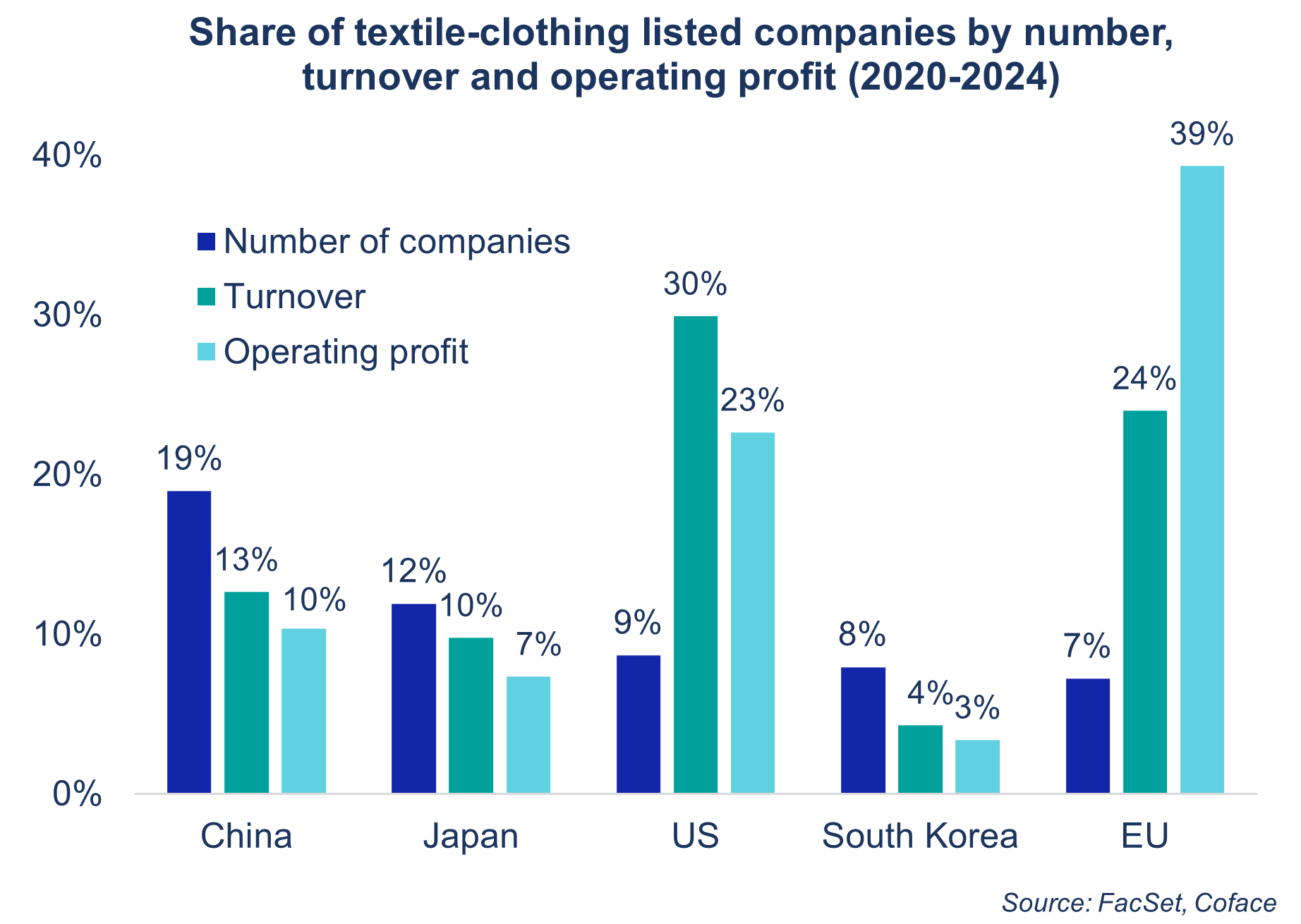

This decline can be explained by an economic model focused on subcontracting for Western brands. However, these manufacturing activities are very low paying in the value chain. Thus, despite their significant weight in terms of number of companies (19% of the global total), Chinese players generated only 10% of the sector's profits between 2020 and 2024.

This loss of competitiveness is accentuated by the continuous rise in wages (+6% per yearon average since 2010). In 2000, an American employee earned 18 times more than a Chinese worker, compared with only 4.6 times more in 2023. Added to this are new regulatory constraints, particularly environmental ones, which are increasing production costs. These are all signs that the Chinese model is running out of steam in a context of increased global competition.

data for the graph in xls format

Uniform customs duty scenario: South Asia lying in wait

Donald Trump's return could accelerate the diversification of textile supply chains away from China. Coface has developed a country attractiveness index based on the availability of low-cost labor, the existence of an established apparel industry and ease of doing business.

In an initial scenario where all of the United States' trading partners are subject to uniform customs duties of 10%, except for China, which is penalized more heavily1, the countries best positioned to capture market share are Bangladesh, Cambodia, Pakistan and Vietnam. India, ranked 6th, could also benefit from the development of its vast domestic market. Finally, post-Covid relocation could benefit countries such as Albania and Georgia in Europe, and El Salvador for the US market.

Reciprocal customs duty scenario: Europeans better equipped

In this second scenario, the US administration introduces differentiated customs duties, in line with the reciprocal measures announced in April and subsequently suspended. In this situation, our index suggests that customs duties would not be enough to erase Bangladesh's competitive advantage. Despite a high rate (37%), the impact remains limited thanks to its low dependence on the US market and its strong ties with the European Union.

Conversely, countries such as Vietnam, Lesotho and Jordan would lose more competitiveness. European countries, on the other hand, would benefit from a relative advantage, with lower tariffs and less exposure to the US — unless there is a sudden increase to 50%, as Donald Trump threatened at the end of May.

Download the "Reconfiguration of global clothing supply" now

(.pdf 3,04 Mo)

[1] 55% customs duties for China until 12 August